For first-go out homebuyers, this might entail closing a current renter’s insurance policy and you loan places Weatogue can transitioning so you can a more recent, a whole lot more full visibility plan. You will find about three version of home insurance coverages: cash well worth, replacement for rates, and you will extended substitute for rates/well worth.

Lender’s Term Insurance policies

This might be an upfront, one-time payment paid back towards term company one protects a loan provider in the event the a possession dispute or lien appears which had been perhaps not located about term look. Occasionally, the financial institution may not initial identify an issue with the brand new term out-of property. The buyer may also discover coverage up against unanticipated label issues.

Lead-Created Decorate Inspection Percentage

You might spend an authorized inspector to determine should your assets have unsafe, lead-mainly based color, that is you’ll be able to into the land established in advance of 1979. It can costs about $336. These degree is not required, whether or not adding a contribute-depending decorate contingency will deteriorate all round offer suggestion.

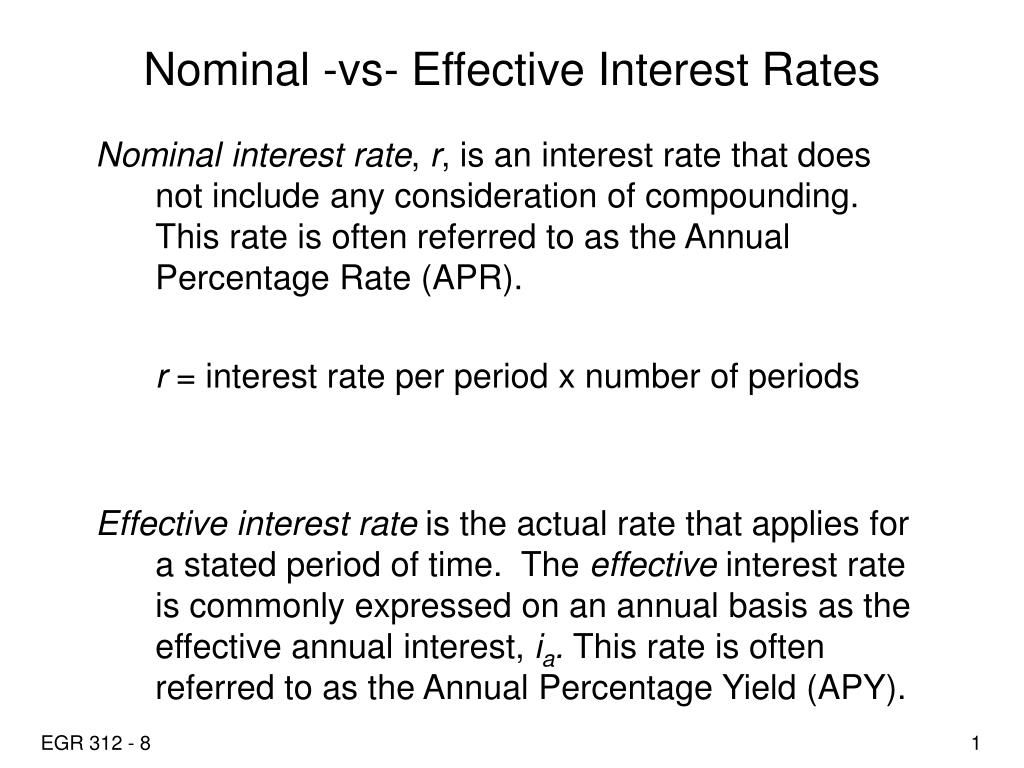

Products

Issues otherwise disregard points consider an optional, initial payment towards the financial to attenuate the interest rate on your loan and you will and so decrease your payment per month. One-point means 1% of your own loan amount. Within the the lowest-speed ecosystem, this could not save you far currency.

Customer’s Name Insurance policies

A name insurance handles your regardless of if people challenges your possession of the home. It certainly is elective but strongly suggested because of the legal benefits. It constantly costs 0.5% to 1% of your own purchase price.

Origination Percentage

The origination fees discusses the latest lender’s management can cost you in order to process the percentage which is generally step 1% of your loan amount. ? ? Certain loan providers do not charges origination charge, however if they won’t, they often charge increased rate of interest to pay for costs.

Insect Examination Fee

This is certainly a charge that covers the expense of a specialist insect examination to possess termites, dry rot, or any other insect-relevant destroy. Particular says and some authorities-insured funds have to have the assessment. It usually will cost you on $100.

Prepaid service Every single day Attract Costs

That is a payment to pay for one pro rata desire on your own home loan that may accrue from the go out away from closure up to the date of one’s first mortgage percentage. So it count will often be pre-lay as closing methods and additionally be modified whether your closure day changes about what is originally requested.

Private Financial Insurance (PMI)

In case your deposit are lower than 20%, your own bank you may need private mortgage insurance policies (PMI), and you also I commission on closure. PMI protects the lender any time you will be stop and also make costs in your loan. Often, there clearly was a single-big date, upfront PMI superior paid during the closure. Or even, PMI is more aren’t a monthly advanced put in your own mortgage advanced.

Property Appraisal Percentage

This really is an essential payment paid off to help you an expert household appraisal company to assess the fresh new home’s fair market price accustomed influence your loan-to-worthy of (LTV) proportion. It’s always ranging from $3 hundred and $425. Of a lot loan providers will demand a house appraisal to ensure possessions monetary requirements is fulfilled regarding your property therefore the financing getting sustained for the property before issuing the mortgage.

Assets Income tax

In the closure, anticipate paying one pro rata property fees that will be due on date of closing for the stop of your own tax 12 months. Similar to attention, the prorated amount might be lay according to an anticipated closing time. Is always to it time score pressed back, the level of possessions taxation reviewed may differ.

Speed Secure Fee

That is a fee billed because of the financial having promising your a certain interest (securing in the) to have a small period of time, typically since that time obtain a pre-recognition up to closure. It can work on out of 0.25% in order to 0.5% of your mortgage worth, while some lenders give a performance lock 100% free. A mortgage calculator can display the feeling of different cost on the monthly payment.