Lenders Instead Mode sixteen

Mode sixteen is an important document at your home financing acceptance procedure. Setting sixteen can help your bank guarantee your income and you can, thereby, their replacement for capabilities. But not, there is situations where you simply cannot also provide your own financial which have a type sixteen. This is also true getting care about-functioning anyone such freelancers. In such instances, you happen to be capable submit an application for a mortgage without Mode sixteen. Read on for more information.

Knowledge Home loan Instead Form sixteen

When you find yourself a beneficial salaried worker, you iliar with Means 16 when you find yourself filing income taxespanies and group need grasp the constituents, qualification, and you will strengths to make sure taxation compliance.

Mode 16 enables you to file your earnings tax returns simply. It is proof that your manager submitted the cash that has been subtracted because TDS from the salary on the authorities. It also demonstrates to you how your own taxation try determined with the financial support declarations you have made early in the fresh fiscal 12 months.

Lenders consult files to decide your qualification and you may creditworthiness having home loan recognition. Means 16 is right whilst gives details about your income, also bonuses and you can allowances, and you will people tax-rescuing possessions you have got expose towards the providers.

A mortgage versus Function sixteen you may voice tricky, given their pros, but it’s perhaps not hopeless. Certain documents may help your circumstances to possess home financing in place of Function 16, specifically for non-salaried.

Selection in order to create 16 to possess Non-salaried Some one

When the Form sixteen is not available for home financing, salary slides, financial statements, and taxation efficiency would be put alternatively.

Income slips is have indicated typical money out of employment, whenever you are bank comments can display repeating dumps of care about-a job and other sources. Taxation output are essential as they bring an intensive assessment of a person’s earnings out-of some offer, in addition to organization, opportunities, or any other streams.

In addition, some lenders get demand audited financial comments or specialized levels regarding chartered accounting firms for mind-employed someone or entrepreneurs to help you validate their income states.

Setting sixteen is commonly necessary for lenders as part of the paperwork processes getting a mortgage application, however it is maybe not area of the cause of deciding financing acceptance. Even although you don’t possess Form sixteen, you could potentially be sure your revenue and you may qualify for a home mortgage various other suggests. Check out choices.

When you have recorded your income taxation statements to your appropriate comparison season, you may also promote duplicates of your own ITR acknowledgement because proof earnings. Lenders frequently accept ITRs due to the fact evidence of earnings balances and income tax compliance.

Bringing salary slips on the previous few weeks can serve as evidence of the normal earnings. Income glides commonly incorporate pointers such as earliest income, allowances, and write-offs, which loan providers used to dictate the payment ability.

Bank comments about earlier six months so you can a year you will help lenders from inside the determining your financial health and repayment possibilities. Normal pay credit and other money avenues in your bank statements may help the loan software.

The loan app can include a page from your boss outlining their designation, work condition, and pay information. Lenders may demand which document to verify work condition and you will money.

In a number of things, especially for worry about-employed or people with unstable money, acquiring a full time income certification out of an excellent chartered accountant or an experienced financial mentor may help you show your income.

If you are looking to possess a mortgage purchasing a beneficial property, you could service the job by the offering needed paperwork such as for instance the business contract, possessions assessment declaration, and identity deeds.

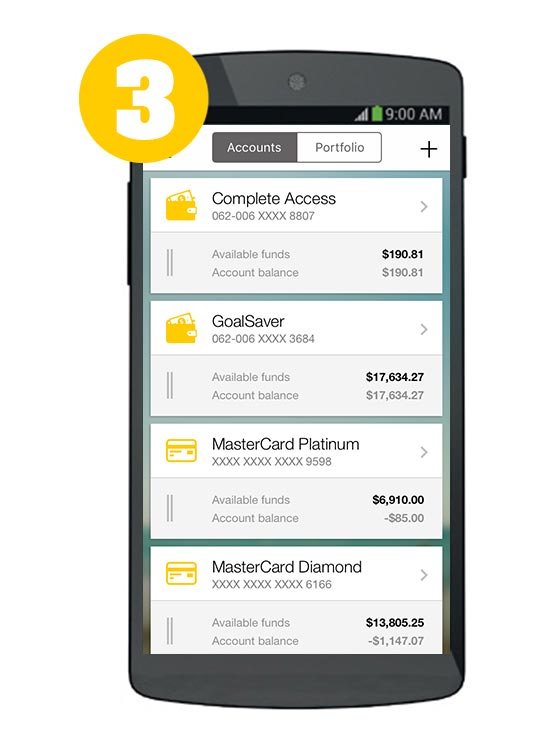

Step-by-Action Guide to Making an application for a mortgage Versus Mode 16

When trying to get a mortgage instead of Setting sixteen, thorough preparing and you may believed are needed beforehand. You should determine your allowance, lookup loan providers, and you can gather solution money-facts data.

Determine your total monthly earnings out-of all the present. Money proofs particularly financial comments, ITR acknowledgements, paycheck slides, book contract copies, an such like., would be to demonstrate carried on cashflows the past 6 months. If the you can find people holes, provides an excellent co-applicant which have solid income data.

Shortlist lenders according to rates of interest given, operating charges, pre-percentage costs, an such like. Go to the websites to check qualifications requirements, the loan amount you can buy, and you may data files needed.

Look at the lender’s department which have photocopies out of KYC records (Aadhaar, Bowl Cards), six months’ financial statements, a couple of years’ ITRs when the readily available, and you can alternative proofs such as for example income slips, book receipts, team income proof, an such like.

Submit the home application for the loan mode getting individual, money, loan amount and you can property info. Your credit score, works sense, and you will connection with the financial institution tend to effect loan eligibility.

The financial institution commonly make sure facts thanks to borrowing monitors, CIBIL get, tele verification, tech research of the property, courtroom position monitors, etcetera. Render any additional records expected on time. Recognition times ranges off 7 days so you’re able to thirty days, dependant on personal users.

An important is actually preparation – have a look at in the event your full economic reputation is also make up for shortage of Form 16, keeps contingencies for huge downpayment if needed, and gives genuine choice proofs to determine cost skill. Be clear, act promptly to lender queries, and you can influence present relationships to raised the possibility.

- Is worry about-functioning anyone rating home financing in place of Mode 16?Sure, self-operating someone or the individuals in the place of a consistent salaried money can always get a mortgage no matter if they do not have Mode 16. Loan providers may undertake option documents such as for example taxation yields, financial comments, audited economic comments, otherwise earnings certificates of an effective chartered accountant because proof income and you may payment strength.

- Why does the speed into a home loan instead of Setting sixteen compare with a frequent financial?Lenders will get envision home loan applications in place of Function 16 as higher risk, and that, the speed billed with the for example financing is somewhat large as compared to price having typical mortgage brokers in which Means 16 is actually given. The actual difference in interest levels may vary across the lenders and now have relies on the fresh new applicant’s complete economic profile and creditworthiness.

If you’re Form sixteen stays an important file getting mortgage acceptance, its absence must not dissuade you against obtaining a home mortgage. To provide option proofs particularly ITRs, bank statements quick loans Lake Pocotopaug Connecticut, and you may earnings permits can help you have shown your own payment potential and you can financial balances so you’re able to lenders. Comprehensive thinking, visibility, and you will promptness inside the responding to financial concerns can also be significantly improve your odds of securing home financing in the place of Function 16. Explore Aadhar Housing’s amount of financial products designed to get to know your unique demands.