Simple tips to replace your home loan rates with a beneficial 650 credit score

step one. USDA mortgage

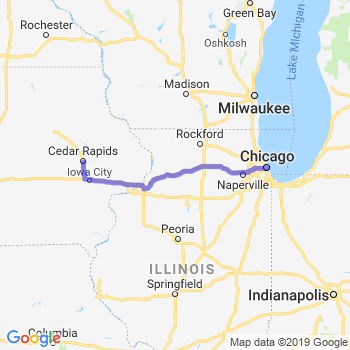

Homeowners seeking to a devote a rural area may want to make use of this financing. Interest rates are aggressive, and also you do not have to put any cash down. The house or property need to be within the a being qualified region of one to pull out an excellent USDA mortgage.

2. FHA loan

FHA financing is actually easily offered to property owners with lower fico scores. If one makes an effective ten% downpayment, you can aquire an FHA mortgage even though you possess an effective five hundred credit rating. For those who have good 580 credit history or maybe more, you can aquire an FHA mortgage. The newest FHA is actually a compliant mortgage with limits about precisely how far you could potentially acquire on the bank. People constraints transform every year and believe the fresh area’s costs out-of way of living.

3. Old-fashioned mortgage

Antique financing commonly covered or protected of the bodies. As they tend to have stricter credit rating requirements, specific loan providers provide conventional finance so you’re able to consumers with a credit rating regarding 650. However, it may be harder to secure beneficial conditions and you will desire costs as compared to consumers with higher credit scores.

cuatro. Va loan

Virtual assistant funds try only for experts just who supported prior to now otherwise is definitely serving. Partners out-of army participants can also qualify for Virtual assistant money. These finance do not have downpayment requirement, down rates, lower closing costs, and no private financial insurance coverage.

Increasing your own get can help you qualify for highest financing numbers which help get straight down rates. Lees verder “Simple tips to replace your home loan rates with a beneficial 650 credit score”