A 550 FICO credit score is recognized as strong subprime, depending on the Consumer Economic Defense Agency. This new Fair Isaac Enterprise (FICO), which is one of the most widely used credit rating measures, categorizes credit ratings out-of 579 otherwise straight down just like the terrible.

How dreadful credit has an effect on pricing

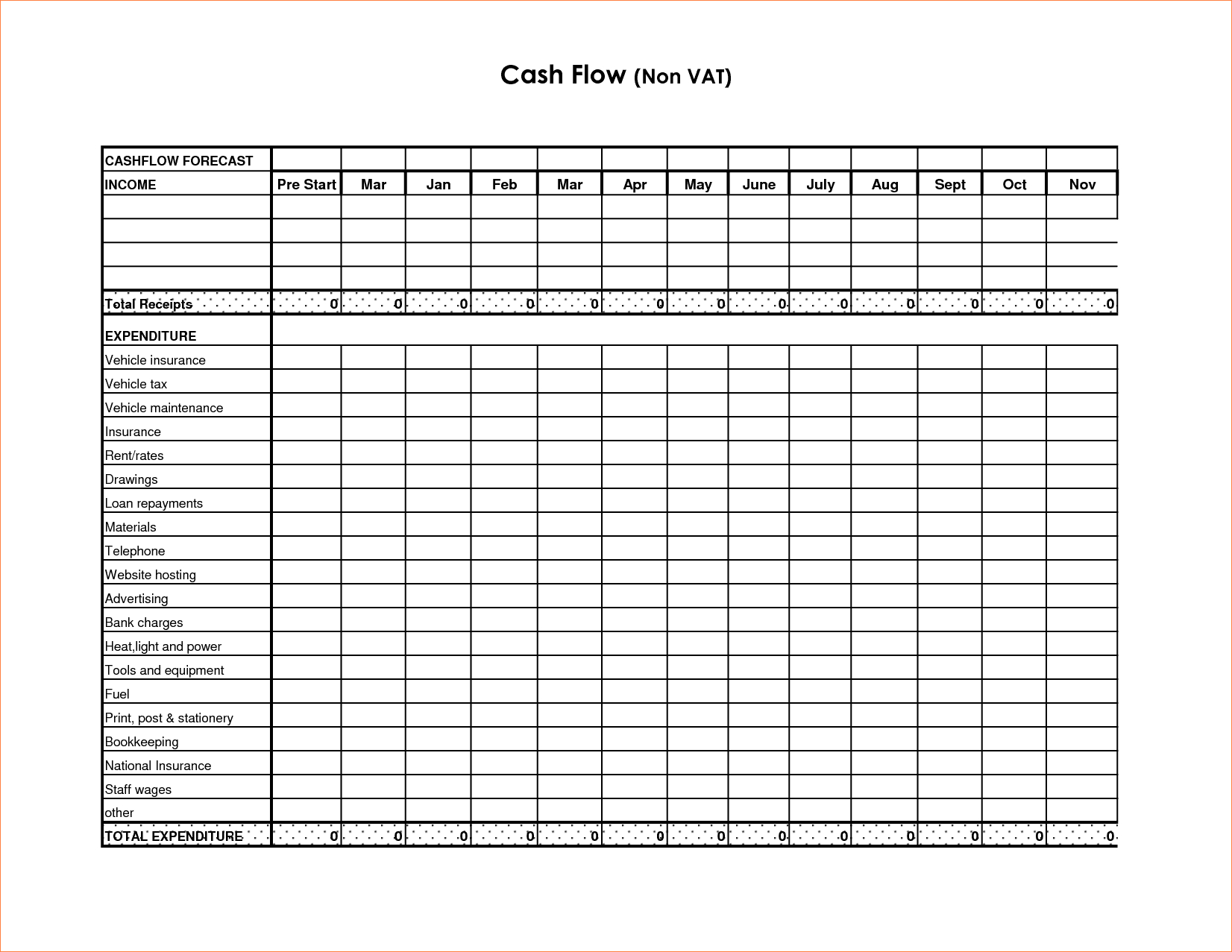

Lenders pick a lowered rating due to the fact a sign of risk. Therefore so you can counterbalance losings of possible overlooked money or a good defaulted loan, loan providers often costs regarding focus in the event the debtor has actually poor credit. Average loan interest rates mirror which practice:

The way to get a personal loan that have a beneficial 550 credit rating

Getting an effective 550 credit rating mortgage tend to be challenging. You will need to be thoroughly willing to navigate the procedure.

Research thoroughly

- Avant: Avant gives to the people which have credit ratings as little as 550.

- Upstart: Upstart sets no lowest credit score demands. Instead, its recognition program investigates your earnings and you may degree peak, certainly one of additional factors. Upstart is new 2024 Bankrate Prizes select to own better crappy-borrowing from the bank lender.

Additional loan providers appeal to those with down fico scores. Yet not, make sure to filter the disreputable of those before you apply. Have a look at recommendations on the 3rd-people programs including Trustpilot to feel aside a great lender’s reputation and you can come across models in the customers’ experiences.

Together with, be suspicious out of large costs and you can short terminology which could make challenging to keep up with costs. Providing stuck within the a period off broadening loans and you may non-payments you can expect to definitely damage your bank account.

Look around and you may prequalify

Eligibility advice typically differ by financial. It is vital to browse numerous loan providers to determine and this bank is best for your.

Specific bank other sites function a prequalification tool that allows one to see possible financing now offers, and monthly installments and cost, versus injuring your credit rating. If you officially use, the lending company may conduct a difficult credit assessment that will ding your credit rating from the a number of points.

Imagine secured loans

Such loan is actually shielded by collateral, such property, an automible or other goods of value. You can easily generally advance loan conditions, however exposure your own resource if you default on the mortgage.

Try borrowing unions and local banks

Will, with an existing connection with a residential district place is beneficial, as they usually have even more liberty and may also end up being happy to capture an alternative check your profit and you will view your application based on more than simply your credit score, states loans lawyer Leslie Tayne, creator out of Tayne Legislation Category.

Come across a good co-signer

Thought selecting a good co-signer that have a stronger credit history if you can’t qualify your self. Of numerous lenders will provide fund when they guaranteed of the some one that have good credit, states Sullivan.

Solutions so you can signature loans

If you’re unable to score a consumer loan or the rates of interest you are given are way too steep, believe personal loan alternatives.

- Improve your borrowing: Perhaps not on the go to get the currency? Think spending some time dealing with enhancing your credit rating to help you improve probability of qualifying for finance with additional good words.

- Unsecured loan out-of a friend or relative: Select anyone having the person you have a good dating and you will be comfy sharing individual financial info. Make sure to obtain the contract, like the payment count, written down to end any confusion subsequently.

- 401(k) loan: Believe borrowing from the bank from your own advancing years money for those who have a manager-backed 401(k) bundle. Such fund do not require a credit assessment. However they incorporate low interest, you pay so you can yourself anyway, Tayne claims. Although not, know that for individuals who get-off your work otherwise are fired, you should pay back your 401(k) mortgage from the second federal taxation go out.