This information are confronted with a comprehensive fact-checking process. Our very own professional fact-checkers make sure post information up against first supply, credible editors, and you can specialists in industry.

We found payment on the services mentioned inside story, however the opinions may be the author’s ownpensation may impact where also provides come. You will find maybe not included all readily available facts otherwise also offers. Learn more about the way we make money and all of our editorial policies.

Understanding your credit report should be a giant assist because you package your financial upcoming. Having the ability to tune your credit score helps you find whether your qualify for certain borrowing products, rates of interest, and you can properties – also it can also make it easier to determine the borrowing strengthening progress to see crucial change on the credit suggestions.

Cheerfully, checking their credit score won’t damage their borrowing. And using a support particularly Borrowing Sesame otherwise Credit Karma normally keep you on top of their borrowing from the bank situation. However, which should make use of? Here’s an in-breadth check Borrowing Sesame vs. Borrowing Karma.

- Credit Sesame against. Credit Karma

- What is actually Borrowing Sesame?

- What’s Borrowing from the bank Karma?

- Borrowing from the bank Sesame vs. Credit Karma

- Conclusion: That ought to you decide on?

What is actually Borrowing from the bank Sesame?

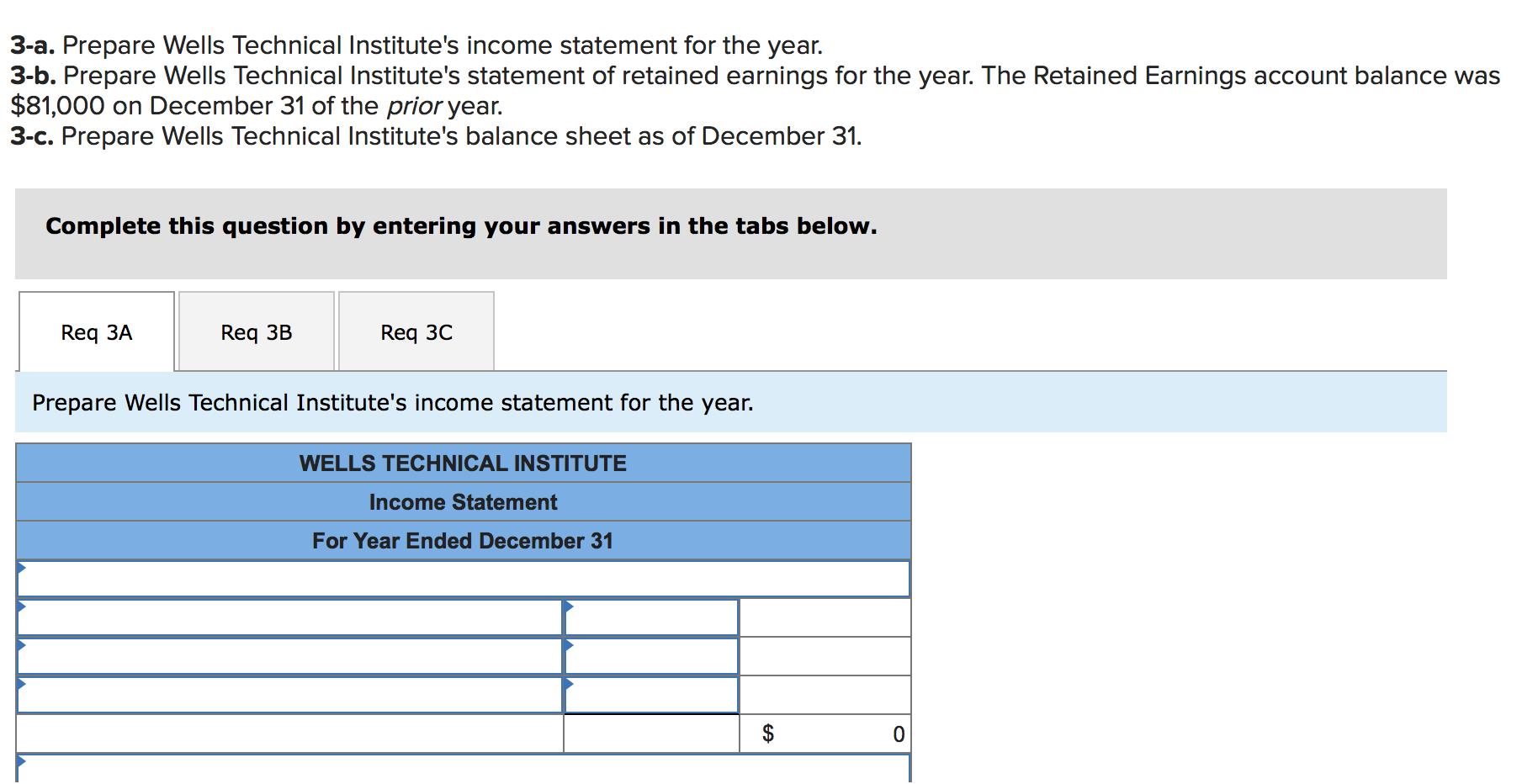

Credit Sesame try a deck that offers credit score tracking, one of other features. After you create an account, you will find your TransUnion VantageScore. The VantageScore will be based upon a rating model produced by new around three big credit reporting agencies. This can be unlike your FICO get, which was the industry simple for a long time and you will is made because of the Fair Isaac Organization.

Bear in mind

You’re likely to get different quantity with regards to your own VantageScore in place of your own FICO get since the formulas employed by for each credit rating design high light a little something else.

Borrowing Sesame offers a standard idea of the credit problem. The fresh get the thing is into the Borrowing Sesame try a base individual score, there is differences in exactly what a lender notices if the they look at the credit score after you make an application for a loan. You could still score a thought whether your credit history is good.

With Borrowing from the bank Sesame, you can even look at different factors of your finances and also have useful information. The working platform has the benefit of some has. You have access to any of these provides free-of-charge, and others is actually perks only available getting Credit Sesame+ registration superior profile, and that pricing $ or $ 30 days with regards to the bundle you select.

100 % free credit rating

You can discover advice out of Borrowing from the bank Sesame on the different aspects out-of your borrowing from the bank and you can what causes your credit rating. You can find a different sort of credit score every single day as it is current all day.

Borrowing Sesame in addition to explains the new perception for every single factor has on your own rating along with in which you currently fall with every regarding all of them – and installment loans online South Carolina you skill adjust.

Credit history notifications

You can examine borrowing alerts on your Credit Sesame account due to the fact really. This consists of information about once you located a credit score improve, as well as whenever you are overdue to your a payment. Borrowing from the bank Sesame have a tendency to pick outstanding levels and you will show exactly how they’re impacting your own score.

Borrowing from the bank Sesame also provides advanced alternatives for borrowing from the bank and you can identity monitoring. On the 100 % free adaptation, you can just see alerts from 1 borrowing from the bank agency (TransUnion). For people who spend a monthly fee regarding $, you can purchase credit keeping track of for the about three fundamental bureaus.

Sesame Dollars

Borrowing from the bank Sesame also provides an effective Sesame Bucks prepaid debit card awarded of the Society Federal Savings Lender. it has actually a card builder choice, that requires beginning a guaranteed virtual mastercard funded by your Sesame Cash card.