Are you aware that bank’s prior financial push, the Ceo said it made numerous money, “but one markets changed much

By the end regarding just last Candlewood Lake Club pay day loan year, Earliest Opinions Home loans got scaled straight back their home loan footprint to 250 merchandising and you will 31 wholesale centers, along with June the firm revealed a great deal to sell much more than simply 230 financial practices so you can MetLife Lender, though Earliest Opinions often retain 21 home loan practices in and around the new Voluntary County.

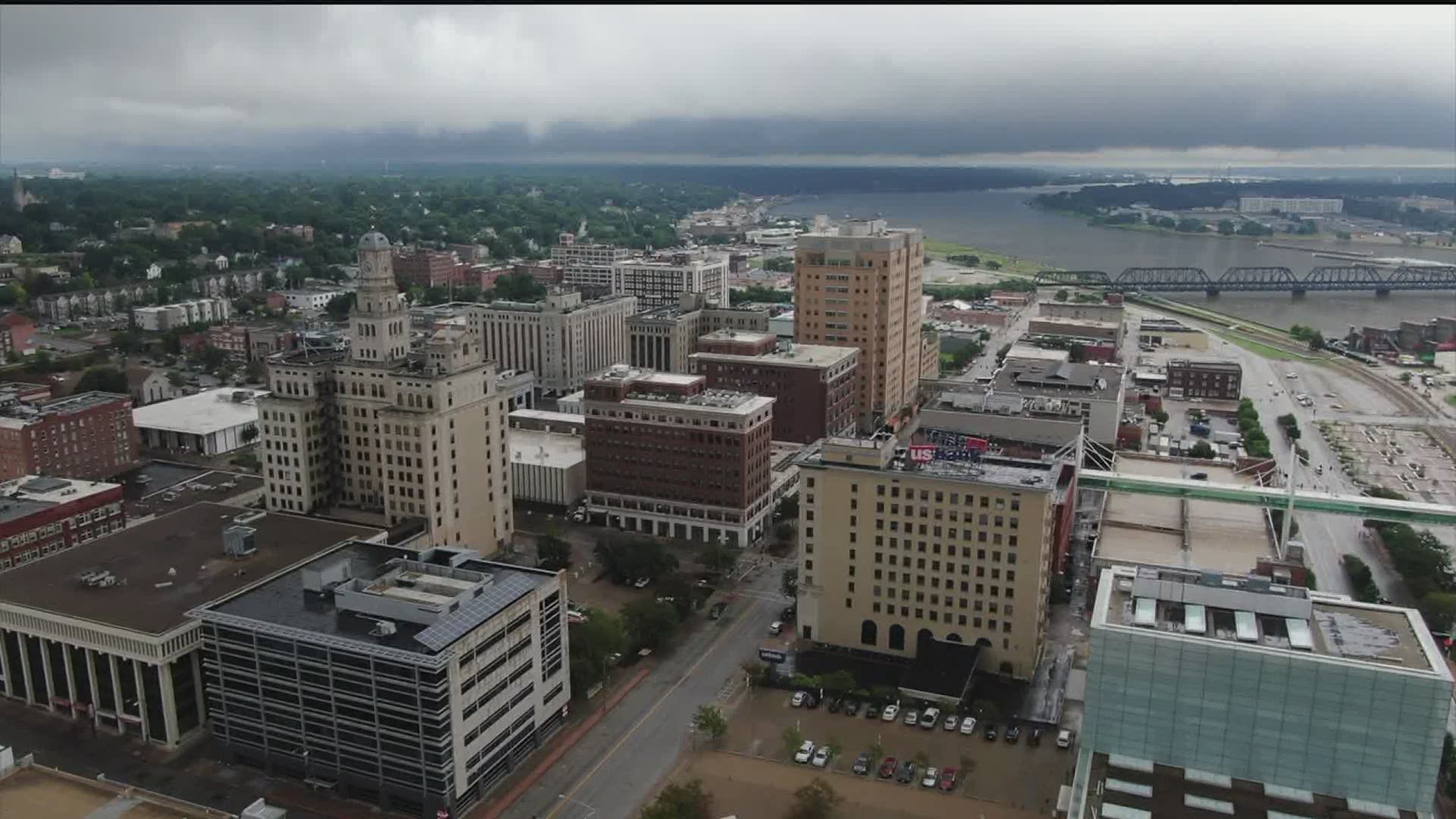

At the same time, Very first Panorama provides sold their 34 branches into the Georgia, Maryland, Virginia and Tx, including 9 workplaces in the Atlanta that have been bought by Cincinnati-created 5th 3rd.

The latest financial team comes with established a halt so you’re able to federal domestic-builder and you will commercial home financing which can be winding down the as much as $9 million national specialization credit collection, with financing to family builders and you may consumers out-of freshly centered homes in striving locations such as for example Florida and you will Ca.

The effect might possibly be a significantly reduced house foot, but team managers and separate experts state which is the great thing.

“Our very own mortgage lender don’t make currency just last year,” Baker said. “So if you eliminate anything that’s not and work out any currency and you also lay (resources) toward something renders more cash, that really is going to boost (really worth to own) new shareholders.”

Their money , First Views sustained a websites loss of $170 mil, otherwise $step 1.thirty-five within the diluted money each show, down off a profit out of $step three.62 for each and every express within the 2006. The new 2007 rates incorporated a great pre-taxation death of $336 million in its home loan financial sector, and also the company plus was compelled to improve reserves due to problems in the residential design profiles, particularly in shaky federal avenues.

James Schutz, a good investment specialist with Sterne, Agee & Leach, that has various cover levels unlock having Earliest Panorama, said new revenue in order to MetLife plus the shorter house feet basically could well be an optimistic to possess shareholders, as he indexed that the downsizing usually take back resource.

One to sentiment is echoed from the Costs Sansom, who’s TVA president, leader regarding H.T. Hackney Co., and you will a manager regarding First Views once the 1984. Expected the way the panel seems in regards to the overall performance out-of Baker and his group, Sansom told you banking might have been a tough team over the last season.

“We have been pleased with the new MetLife decision; however the fresh panel is actually working in one to conversation and techniques, and undoubtedly i decided to get out of banking institutions that were outside the Tennessee market town, and so we have been pleased with in which the lender is now,” the guy told you.

In terms of shareholders who may be upset along the decreasing value of its resource, new director said the guy cannot blame them.

“But I think exactly what we were left with is actually a focused bank,” the guy told you. “Therefore learn it is the largest bank for the Tennessee, and you will Tennessee’s a growing market, and that i consider where we are is a great destination to be today.”

Their latest professionals, the guy told you, “have been installed to fix the difficulty, and you will, i believe, they’ve got went a considerable ways on the carrying out one

To have Baker, the business’s the new advice possess suggested leaving attempts that the guy are directly in it. In advance of his jobs due to the fact Chief executive officer and master operating administrator, he was president away from federal financial features toward business, supposed up the federal extension means.

Asked whether or not he offered the federal branch expansion, Baker told you, “I was expected to do it and to feel an associate of it, therefore i served it and did what it ? took to do you to definitely method.”