Of many prospective people are interested in assets and want to see if you’re able to score a home loan versus permanent a job. Home is probably one of the most prominent investment, whether for personal play with or even for resource intentions. Its low in exposure and you can reasonably anticipate a beneficial assets that you ordered to be well worth significantly more the coming year.

Many potential buyers behave as designers from inside the a fixed name otherwise enterprise basis. Some are freelancers otherwise independent designers working in the newest gig discount. There is certainly a special process for finding a home loan when self employed, which is different to being employed with the a contract that is normally prolonged. Right here our company is covering the problem where you are used by a buddies, not on a low-permanent base.

There’s a tremendously popular opinion that attain a home loan you ought to have a permanent work. This rationale is reasonable since home financing is typically for a lengthy period, always anywhere between 20 and thirty years. It can then make feel one to having a long-term employment form that the risk of your having the ability to shell out a loan for the a lot of time function better. But is it really?

Lenders and Permanent against Bargain Employment

Times is modifying. The use price is quite filled with Southern area Africa and plus businesses are hiring into the a good contractual base and you will less someone get hired to the a long-term base. At the same time, banks need to continue steadily to return. The essential procedure off a bank is to try to lend currency and you will make a profit on focus. With less and you may fewer somebody being permanently operating, financing procedures need slow switch to complement in the employment surroundings, or finance companies is certainly going out of business.

Do you really Rating A mortgage Instead of A permanent Occupations?

The newest short response is yes, you should buy home financing in place of a permanent employment. Yet not, there are certain things that you may need positioned before applying to have a home loan in place of a long-term employment. With an excellent work and borrowing from the bank reputation tend to alter your chance of getting mortgage.

When i wanted to pick my very first assets, Used to do enough lookup with the if I needed an excellent long lasting business to acquire a mortgage. I experienced a total of five years works experience, all the around fixed identity deal. I never taken out a mortgage early because We heard most minutes that you ought to feel permanently useful to get access to house financing. Recently, when performing search on the amount, I discovered little in writing to ensure which. So i only generated the application to ascertain having myself.

Pre-Approval

Exactly what encouraged us to create a mortgage software program is the fresh new Nav >> Money ability toward FNB software. The fresh function told me most of the credit place that we be considered getting and you can not as much as home loan, they asserted that I really do be eligible for a home loan. This is whenever i commonly still performing merely gig discount jobs.

Brand new environmentally friendly club having mortgage wasn’t because the full since it is today however, FNB performed give a reason into the how to boost it during the software. We labored on improving it of the making certain that I did not spend all the cash I experienced inside times. I got about 1 / 3rd of currency I obtained when you look at the 30 days leftover within my membership after new few days. The amount of time to alter they a couple in which it is (from around 65% to over 85%) from the a lot more than image are 4 days.

The brand new FNB app has the benefit of an option to rating pre-acknowledged to have home financing regarding software thus i applied to possess pre-recognition as well as the next day I’d a beneficial pre-acceptance current email address and you may a thread form.

Just after studying the program, We watched that there is actually an area where it inquired about permanent a job. During that time, I decided to maybe not sign up for a mortgage from financial. I would personally save up having a deposit and implement by way of an excellent thread maker once i had saved up the cash.

Implementing As a consequence of A bond Founder

Immediately after preserving upwards, I called a thread originator and required thanks to their own pre-acceptance procedure The reason for implementing because of a bond creator are that i discover in a lot of stuff you to definitely bond originators can afford in order to negotiate on banking companies on your behalf. For those who pertain alone, you simply cannot discuss while the results lays exclusively exactly how your software seems on paper.

The fresh heartening most important factor of the application regarding the bond creator is the fact there is zero concern on permanent a position. Just after becoming pre-accepted, We generated a deal for the property I needed buying and house broker registered the papers in order to bond originator. In this each week, I’d a response on first bank, stating that that they had accepted my personal app in theory.

Occupations And you may Credit score status While i Applied for A mortgage

As i produced my personal financial software I happened to be into next week away from a position for a that’s I became on a 3-week deal that i are sure will be renewed. I’d already been performing an online business to have a year in advance of that. I found myself taking a few salaries once i used however the financing count which i was pre-accepted having is actually the utmost for what I’m able to manage during the your day job by which We introduced a cover slip.

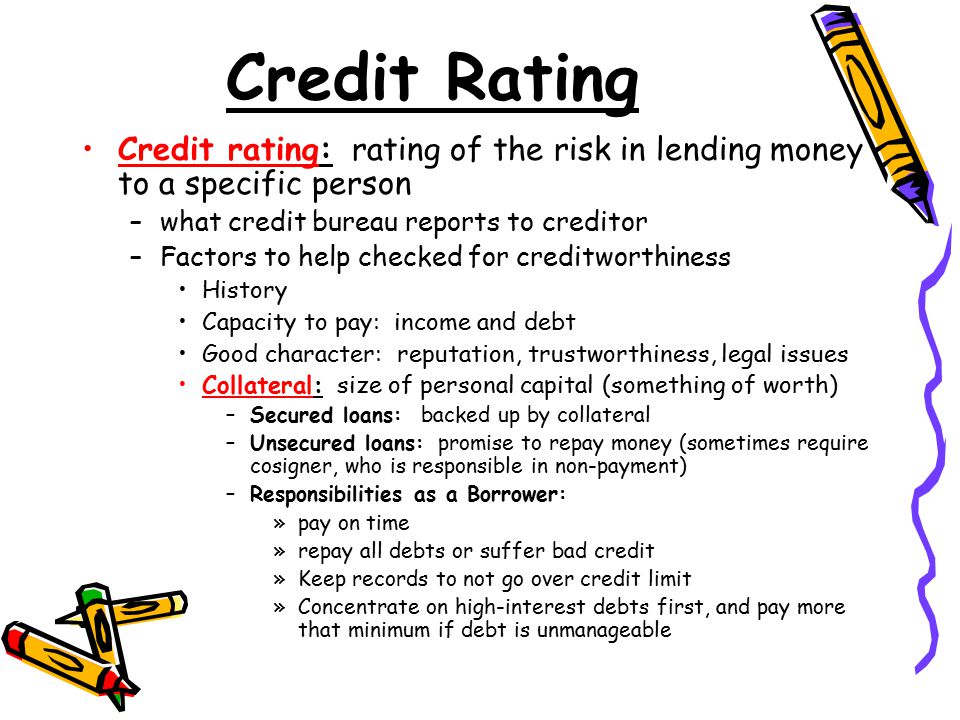

My personal credit status is actually classified once the pretty good, that’s cuatro regarding 5, otherwise a stride below the best possible rating. This stems primarily off with had car money for a few years rather than forgotten a cost toward vehicle. Outside you to definitely, my just borrowing from the bank try a cell-cellular telephone package and a good Telkom phone line that i had had for all many years.

My personal credit score was not clean. The major procedure was to perhaps not standard to the products which expected a credit software. Which have been through a detrimental plot couple of years earlier, I’d defaulted towards two things along the way. When you manage read an emotional financial months, this isn’t the end of the nation, you ought to simply bust your tail within fixing your credit score.

Things that you should get a mortgage

- Payslip

- Good credit Checklist

- 3-six months bank comments

The fresh payslip shows that youre indeed functioning. The 3-6 months financial statements verifies your bringing cash in your account month-to-month and that you can afford to repay a beneficial home loan. A good credit score implies that you are a reliable borrower and have a high probability of investing your home loan.

Conclusion

You don’t need to possess a permanent employment to acquire a home loan. The fresh new lenders’ main concern is actually assurance your ready to cover your house financing. This is certainly showed using a beneficial credit profile and you can an employment reputation that displays that you’re researching enough money monthly to pay for our home mortgage over a period longer than annually find more.