step one. USDA mortgage

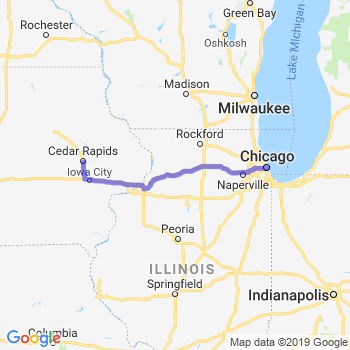

Homeowners seeking to a devote a rural area may want to make use of this financing. Interest rates are aggressive, and also you do not have to put any cash down. The house or property need to be within the a being qualified region of one to pull out an excellent USDA mortgage.

2. FHA loan

FHA financing is actually easily offered to property owners with lower fico scores. If one makes an effective ten% downpayment, you can aquire an FHA mortgage even though you possess an effective five hundred credit rating. For those who have good 580 credit history or maybe more, you can aquire an FHA mortgage. The newest FHA is actually a compliant mortgage with limits about precisely how far you could potentially acquire on the bank. People constraints transform every year and believe the fresh area’s costs out-of way of living.

3. Old-fashioned mortgage

Antique financing commonly covered or protected of the bodies. As they tend to have stricter credit rating requirements, specific loan providers provide conventional finance so you’re able to consumers with a credit rating regarding 650. However, it may be harder to secure beneficial conditions and you will desire costs as compared to consumers with higher credit scores.

cuatro. Va loan

Virtual assistant funds try only for experts just who supported prior to now otherwise is definitely serving. Partners out-of army participants can also qualify for Virtual assistant money. These finance do not have downpayment requirement, down rates, lower closing costs, and no private financial insurance coverage.

Increasing your own get can help you qualify for highest financing numbers which help get straight down rates. Use these strategies to replace your credit score before you could rating nearer to buying your household.

1. Believe a cards-creator mortgage

A cards-creator mortgage are a guaranteed mortgage who has got small monthly payments. The lending company accounts all of the payment to your credit bureau, which can only help change your get for people who spend promptly. As they are secured personal loans, lenders much more substantial due to their credit history standards.

When you are taking care of accumulating their credit otherwise improving your credit score, MoneyLion is here now to help! Borrowing Creator Including (CB+)* is actually all of our effective credit-strengthening registration, and it’s really designed to help the users generate or fix the credit, save your self, establish financial literacy and you may tune their economic wellness. CB+ makes it possible to build or change your credit having the means to access a credit Builder Together with loan.

Philadelphia federal credit union personal loan

A credit Builder As well as loan are a tiny mortgage which is held in a safe membership although you create monthly premiums. Because you generate costs, they are claimed on major credit bureaus, which will surely help boost your credit rating having punctually money. Including, you have access to some of the financing loans as soon since they’re acknowledged, to utilize them for all you you would like.

CB+ mortgage try a simple way to aid alter your borrowing from the bank if you’re paying off your debt. By the boosting your credit history, you can qualify for all the way down interest rates on the future fund or refinancing choice. By paying down your own Credit Builder And additionally loan on time, you can lower your personal debt-to-money proportion, that will together with improve your credit history.

dos. Reduce your borrowing usage price

Settling existing financial obligation usually improve your borrowing use proportion, a component that makes up about 31% of the credit score. Its max to truly get your borrowing application below 10%, however, providing which ratio less than 30% also may help increase your get. When you have good $step 1,000 credit limit and are obligated to pay $100, you have a good ten% credit application proportion.

step three. Focus on paying loans

Settling personal debt produces their fee records, and also a much better impact for many who spend everything you to the big date. Your own commission record makes up thirty five% of your own credit rating, so it’s the biggest classification. Paying down obligations constantly enhances their borrowing from the bank usage proportion, thus centering on that goal is also raise classes affecting 65% of credit history.